Cryptocurrency Overview: Uncovering the Top 5 Crypto Assets to Invest In for 2021

Cryptocurrency Overview: Uncovering the Top 5 Crypto Assets to Invest In for 2021

Cryptocurrency Overview:

Cryptocurrency is a digital or virtual currency that uses cryptography for security. It is not issued by any central authority, rendering it theoretically immune to government interference or manipulation. Cryptocurrencies are decentralized and distributed across numerous computers all over the world, making them incredibly secure and difficult to counterfeit. As such, they have become increasingly popular among traders, investors and consumers alike.

The most well-known cryptocurrency is Bitcoin, which was launched in 2009. However, since then hundreds of other cryptocurrencies have been created with varying levels of success. Most of these “altcoins” are based on the same underlying technology as Bitcoin but offer different features or applications that make them appealing to certain users.

The way cryptocurrencies work is based on a concept called “blockchain” technology. A blockchain consists of individual blocks that contain records of transactions made on the network. These blocks are secured using cryptographic methods and linked together in a chain, forming an immutable ledger of every transaction ever made on the network since its inception. This makes it impossible for anyone to tamper with the ledger without being detected.

One of the most appealing aspects of cryptocurrency is its decentralization – there is no single entity that controls it or can manipulate its price or supply like traditional currencies can be manipulated by governments or banks. This makes it more resistant to inflationary pressures than traditional currencies and gives users more control over their money than ever before.

In addition to being secure and decentralized, cryptocurrency also offers low transaction fees compared to traditional payment methods like credit cards or PayPal. Since there are no middlemen involved in processing payments, costs associated with processing payments are kept low – resulting in lower fees for merchants who accept crypto payments as well as customers who use crypto wallets when making purchases online..

Cryptocurrency has become increasingly popular over the past few years due to its potential for creating new opportunities in finance and digital commerce while maintaining privacy and security for users around the world. While there are still some hurdles to overcome before mainstream adoption can occur (such as scalability issues), many believe that this revolutionary digital asset class has tremendous potential going forward!

What is Cryptocurrency?

Cryptocurrency is a type of digital currency that uses cryptography for security and is decentralized, meaning it does not rely on any central authority or government. Cryptocurrencies such as Bitcoin and Ethereum are becoming increasingly popular, with users being able to send and receive payments with low fees and high speed. The technology behind cryptocurrencies also allows for smart contracts and other applications to be built on top of the blockchain network.

Cryptocurrencies use a distributed ledger system known as the blockchain in order to record transactions securely. This ledger is shared among all participants in the network, meaning that no single user has control over the data stored within it. Transactions are verified by miners who use powerful computers to solve complex mathematical equations in order to verify each transaction before it is added to the blockchain.

The appeal of cryptocurrency comes from its ability to provide users with complete control over their finances without needing to rely on any third-party institutions such as banks or governments. Transactions are secure and anonymous, with users only needing an internet connection in order to access their funds from anywhere in the world. Many believe that cryptocurrencies will eventually replace traditional forms of money due to their convenience, security, and low fees compared to traditional payment methods such as credit cards or wire transfers.

In short, cryptocurrency is an innovative form of digital money that utilizes cutting-edge technology to provide users with increased financial freedom and autonomy. It remains unclear what sort of impact cryptocurrencies will have on our economy over time but one thing is certain – they represent a revolutionary new way of handling your finances.

History of Cryptocurrency

Cryptocurrency is a digital form of money that uses cryptography to secure its transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrency has become an increasingly prominent part of the financial landscape in recent years, particularly with its meteoric rise in popularity over 2017 and 2018. But what is cryptocurrency, and how did it come to be?

The concept of cryptocurrency can be traced back to the early 1980s when cryptographer David Chaum proposed using cryptographic techniques for electronic cash systems. The idea was met with some skepticism, as traditional financial institutions were not yet ready to accept this new form of money. However, it wasn’t until 2009 that cryptocurrency really began to gain traction with the launch of Bitcoin.

Bitcoin was created by a mysterious person or group known as Satoshi Nakamoto who wanted to create an alternative payment system that could operate independently from any government or central authority. This distributed ledger technology (DLT) allowed people around the world to store and transfer funds without having to rely on traditional banks or other third-party intermediaries. As such, Bitcoin opened up a whole new realm of possibilities for online payments and international transactions that have since been adopted by many other cryptocurrencies.

Since then, hundreds of different types of cryptocurrencies have emerged onto the market utilizing different consensus mechanisms like Proof-of-Work (POW), Proof-of-Stake (POS), and Delegated Proof-of-Stake (DPOS). Each type has its own advantages and disadvantages; however, they all share the same purpose—to provide users with an anonymous way to transfer value without relying on centralized authorities such as governments or banks.

Despite its growing acceptance among mainstream financial institutions, cryptocurrency still faces several challenges including scalability issues, privacy concerns, adoption barriers due to regulatory uncertainty, price volatility risks due to speculation in unregulated markets, cyber security threats posed by hackers and scammers looking to take advantage of unsuspecting investors. Nonetheless these challenges should not discount cryptocurrency’s potential for revolutionizing global finance as we know it today – one day soon we may even see it replace conventional currency altogether!

Types of Cryptocurrencies

Cryptocurrencies are digital assets designed to function as a medium of exchange that use cryptography to secure transactions, control the creation of additional units, and verify the transfer of assets. They have become increasingly popular in recent years due to their decentralized nature and the potential for high returns on investment. While there are many different types of cryptocurrencies, they can generally be divided into three main categories: coins, tokens, and utility tokens.

Coin: Coins are digital currencies that run on a distributed public ledger technology called blockchain. Examples include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) etc. These coins represent a store of value and can be used to facilitate peer-to-peer payments over the internet.

Token: Tokens are digital assets issued by companies through an Initial Coin Offering (ICO) that represent rights or access to products or services within the company’s ecosystem. Examples include Augur (REP), Golem Network Token (GNT) and Bancor Network Token (BNT). These tokens usually require you to purchase them with either fiat currency or cryptocurrency in order to participate in the network or receive benefits from it.

Utility Token: Utility tokens are similar to tokens but offer users direct access to products or services instead of just rights within an ecosystem. Examples include Filecoin (FIL), OmiseGO (OMG) and Siacoin (SC). Unlike coins, these tokens don’t provide any store of value but rather provide access to specific networks or products within a given platform.

All three types of cryptocurrencies have their own unique features and benefits which make them attractive investments for certain individuals depending on their goals and preferences when it comes to investing in digital assets. Coins provide investors with a store of value while tokens allow them access into certain platforms while utility tokens give users direct access to products or services offered by those platforms

Factors to Consider When Choosing the Right Crypto:

When it comes to choosing the right cryptocurrency to invest in, there are many factors to consider. Cryptocurrencies have a variety of features and characteristics that make them attractive investments, but they all have different levels of risk and potential rewards. Before investing in any cryptocurrency, it is important to do research and understand the market before selecting a specific coin or token.

First, investors should look at the technology behind each cryptocurrency. The blockchain technology is the foundation for most cryptocurrencies, so understanding its properties can be helpful when deciding which one is best for you. Every blockchain has unique features and characteristics, such as transaction speed or security protocols, which can make some cryptocurrencies better than others depending on what an investor is looking for. Additionally, research into how secure each blockchain is can help inform decisions regarding which ones are more reliable investments over time.

Second, investors should also look at the team behind each crypto project. While it’s important to understand the technical aspects of each coin or token, understanding who created it and their experience with developing new technologies can be just as valuable when making decisions about where to invest your money. Experienced teams that have a track record of success are often more likely to succeed than those with less experience or no reputation in the industry.

Finally, investors should also pay attention to market sentiment around certain coins or tokens before investing in them. This includes looking at things like news articles about particular projects, social media posts from influencers and traders with large followings discussing certain coins/tokens, as well as forums dedicated solely to sharing information and opinions on various cryptos. These sources can provide valuable insight into how people view a given coin/token’s prospects over time – both positive and negative – which can then be used by investors when making decisions about where they want to put their money.

Ultimately, when choosing the right cryptocurrency for you it’s important to do thorough research into both the technical aspects of each project as well as who’s behind them before deciding where you want to invest your money. Doing this will ensure that not only will you get an excellent return on investment if everything goes according to plan but also protect yourself from fraudsters who might try take advantage of unsuspecting investors hoping for quick profits without doing any due diligence on their own part first!

Market Stability and Risk Profile

The stock market is a complex and dynamic environment, with many variables that affect its overall stability and risk profile. In order to successfully navigate this turbulent landscape, investors must be aware of the various factors that can influence the market’s performance. Some of these include economic activity, government policy, sentiment among investors, liquidity in the markets, technological developments, and geopolitical events.

Understanding how each of these elements affects the market is critical for making sound decisions about investing. Economic activity refers to both macroeconomic and microeconomic indicators such as gross domestic product (GDP), employment data, consumer confidence levels, inflation rates, etc. These figures help investors gauge the current state of an economy and anticipate future trends. Government policies also have a major impact on the stock market; shifts in taxation rules or changes in interest rates can lead to significant changes in prices and volatility.

Sentiment among investors plays a large role as well; when investors are feeling optimistic they tend to buy up stocks while pessimism pushes them towards selling off their holdings. Liquidity is another important factor – if there isn’t enough trading taking place it could cause prices to become stagnant or volatile due to low demand/supply pressures. On the other hand too much liquidity can create bubbles which eventually burst sending prices plunging downward. Technological developments have also been known to drastically alter how people trade by allowing for faster execution times and easier access to information from anywhere in the world. Geopolitical events are also important drivers of volatility as political tensions often spill into financial markets causing disruptions and uncertainty about future prospects for certain economies or industries.

All of these elements combine together and affect each other in complex ways that can be difficult for even experienced traders to comprehend at times! As such it is essential for any investor to remain vigilant about monitoring all relevant factors before making any investment decisions so they can accurately assess the current risk profile of their portfolio as well as potential opportunities available in the marketplace

Crypto Volatility

Cryptocurrency markets are highly volatile and unpredictable. This volatility is caused by a combination of factors, including the lack of liquidity in the market, speculation about the future potential of blockchain technology, market manipulation and regulatory uncertainty. The high levels of volatility seen in crypto markets can make them incredibly risky investments for inexperienced traders and investors, while experienced investors may be able to use this volatility to their advantage.

Due to its decentralized nature, cryptocurrency markets are extremely susceptible to external influences such as news events or government regulations. As such, even small changes in sentiment or policy can have a significant impact on prices. Further complicating matters is the fact that there are so many different cryptocurrencies available, each with its own unique risk profile.

A major factor contributing to crypto volatility is speculation about the future potential of blockchain technology. With cryptocurrency prices rising rapidly over recent years, many investors believe they are getting in at the ground floor of a revolutionary new technology that could change the world as we know it. While there is certainly potential for huge gains from investing in cryptocurrencies early on, there is also an incredibly high risk involved due to their volatile nature and lack of regulation in most jurisdictions.

Another important contributor to crypto volatility is market manipulation. A few large players often have disproportionate influence over prices due to their ability to buy or sell large amounts of one asset quickly and without much transparency. This has been especially true for Bitcoin (BTC), where large whales have been accused of manipulating prices and driving up trading volumes artificially with fake buying/selling orders or wash trading (the practice of simultaneously buying and selling an asset).

Finally, regulatory uncertainty plays a major role in creating crypto volatility as well. In countries like China or India where governments have cracked down on digital currencies with stringent rules and restrictions, some investors may become wary about investing further due to fear of possible losses caused by stricter regulations being implemented later on down the line.

In conclusion, cryptocurrency markets are highly volatile because they lack liquidity and face significant external influences such as news events or government regulations. Additionally, speculation about blockchain’s potential future applications as well as market manipulation by whales can contribute significantly toward price fluctuations across all digital assets. Finally, regulatory uncertainty can cause further instability when governments impose restrictions on certain coins which may lead some investors away from these assets altogether out of fear for potential losses incurred due to stricter rules later on down the line

Technology/Innovation behind the Coin

Coin is a digital currency that has been designed to provide a secure and seamless way to transfer money, make payments, and store value. Coin is built on an open source protocol based on the blockchain technology. This technology provides an immutable ledger of transactions and enables users to securely transfer funds to each other in an efficient manner.

The blockchain is a public, distributed ledger that records every transaction ever made with Coin. It also keeps track of who owns what coins and makes sure all transactions are properly authenticated by miners before they are confirmed. This ensures users can trust their funds are safe when making transactions with Coin.

Coin also employs advanced cryptography techniques to protect user accounts from any malicious activity or hacking attempts. The security measures employed by Coin ensure that users’ sensitive data is kept private and secure at all times.

In addition to its security features, Coin also offers users a variety of features such as fast transaction speeds, low fees, easy-to-use wallets, and no chargebacks or refunds for unauthorized transactions. All these features make it one of the most attractive digital currencies available today for those looking for a secure yet convenient way to transfer funds online.

Coin also utilizes “smart contracts” which are automated agreements between two parties for exchanging goods or services without the need for third-party intermediaries like banks or lawyers. These smart contracts enable faster, more efficient transactions while minimizing transaction costs associated with traditional payment methods such as credit cards or bank transfers. This makes it ideal for businesses that require quick payments but don’t want to pay high fees associated with traditional payment methods.

Overall, Coin is a revolutionary digital currency that offers users great security and many unique features not found in other currencies such as Bitcoin or Ethereum. Its innovative technology provides users with peace of mind knowing their funds are safe while providing them with fast transaction speeds and low fees so they can transact quickly and easily without worrying about costly fees or delays in processing their payments

Real World Applications/Adoption Rate

The blog section is an increasingly popular form of internet communication. It allows individuals to share their thoughts, opinions and experiences with a broad audience in a unique way. With the rise of social media, blogs have become even more ubiquitous and are now used by everyone from business owners to hobbyists. As such, there is no one-size-fits-all approach to blogging – instead, each person has the opportunity to create a distinct and memorable presence online through their own content.

In terms of real world applications, blogging can be used for a variety of purposes including marketing, networking and education. Businesses often utilize blogs as part of their overall digital marketing strategy in order to reach potential customers and stay top-of-mind with existing ones. Similarly, professionals use blogs to establish themselves as thought leaders within their field by sharing insights and advice related to their particular area of expertise. Blogging can also be used in an educational capacity – many universities now require students to maintain an active blog as part of their coursework in order to engage with class material more deeply or provide updates on research projects.

Given its widespread use across industries and demographics, the adoption rate for blogging continues to grow steadily year over year. In fact, recent statistics suggest that over 409 million people view more than 20 billion pages every month on WordPress alone – making it one of the most popular forms of content creation available today. Of course, this number doesn’t account for other popular blogging platforms like Tumblr or Blogger which further illustrate the global reach that these sites enjoy.

All things considered, it’s clear that blogging has become an essential tool for anyone looking to make connections online or promote themselves professionally. From entrepreneurs building businesses from scratch to academics researching cutting edge technologies – there isn’t much limit when it comes creating meaningful content through this medium!

Regulatory Environment

The regulatory environment affects the way businesses operate and how they must comply with laws and regulations. It is important for businesses to stay up to date on changes in the regulatory environment, as these changes can have a direct impact on their operations. This blog will discuss what business owners need to know about the current regulatory environment.

Understanding the Regulatory Environment

The first step in understanding the regulatory environment is recognizing that it is constantly changing and evolving. Keeping up with new laws, regulations, and policies can be a daunting task but it is essential for staying ahead of the curve when it comes to compliance. Businesses should make sure they regularly review any new updates or changes related to their industry’s applicable rules and regulations.

Navigating Complex Regulations

Navigating complex regulations can be tricky but there are resources available that can help make sense of them. For example, many government agencies provide guidance documents or overviews of their respective areas of regulation that provide helpful summaries and explanations of key concepts. Additionally, consulting firms or legal advisors may be able to provide additional assistance in understanding specific nuances associated with particular industries or regulations.

Engaging With Regulators

Finally, engaging with regulators directly can help ensure that businesses are aware of any potential changes before they occur. Many agencies host public meetings or workshops where stakeholders have the opportunity to ask questions and learn more about upcoming rules or policies that could affect their operations. Attending such events could prove beneficial for staying informed regarding pertinent issues affecting businesses’ ability to remain compliant within their industry’s regulatory framework.

In conclusion, staying up-to-date on changes in the regulatory environment is essential for businesses looking to remain compliant within their respective industries’ frameworks. Understanding complex regulations may require outside help from consultants or legal advisors while attending public meetings hosted by governing bodies could further aid in remaining abreast of any relevant updates prior to implementation. By following these steps, business owners can better position themselves for success when navigating today’s ever-changing regulatory landscape

Investment Potential and Network Effects

Investment potential and network effects are two important concepts to consider when evaluating an investment opportunity. Investment potential refers to the likelihood that an asset will generate a positive return for investors over time; network effects refer to the increased value of a product or service as more people use it.

Investment potential is based on a variety of factors, such as the current market price of the asset, its historical performance, and its future prospects and growth potential. For example, if you were considering investing in stocks, you would want to analyze the company’s financial statements and assess how well it has performed in the past compared to other stocks in its industry. Additionally, you would need to examine the broader economic climate and determine whether or not conditions are favorable for investment in that particular sector.

Network effects, on the other hand, refer to situations where each additional user of a product adds value for all users who have access to it. This concept is particularly relevant when considering investments related to technology startups – commonly referred to as ‘unicorns’ – which often experience exponential growth due to their ability to tap into large networks of users (e.g., social media platforms). Essentially, these companies are able to leverage their existing customer base in order to attract new customers more quickly than they could otherwise; this process leads directly into higher returns on investment (ROI) as more customers join their platform.

Overall, understanding both investment potential and network effects is essential for any investor looking to maximize their ROI over time. Evaluating these two factors helps inform decisions about which assets may be most profitable over the long term, allowing investors make smarter decisions with greater confidence about their investments.

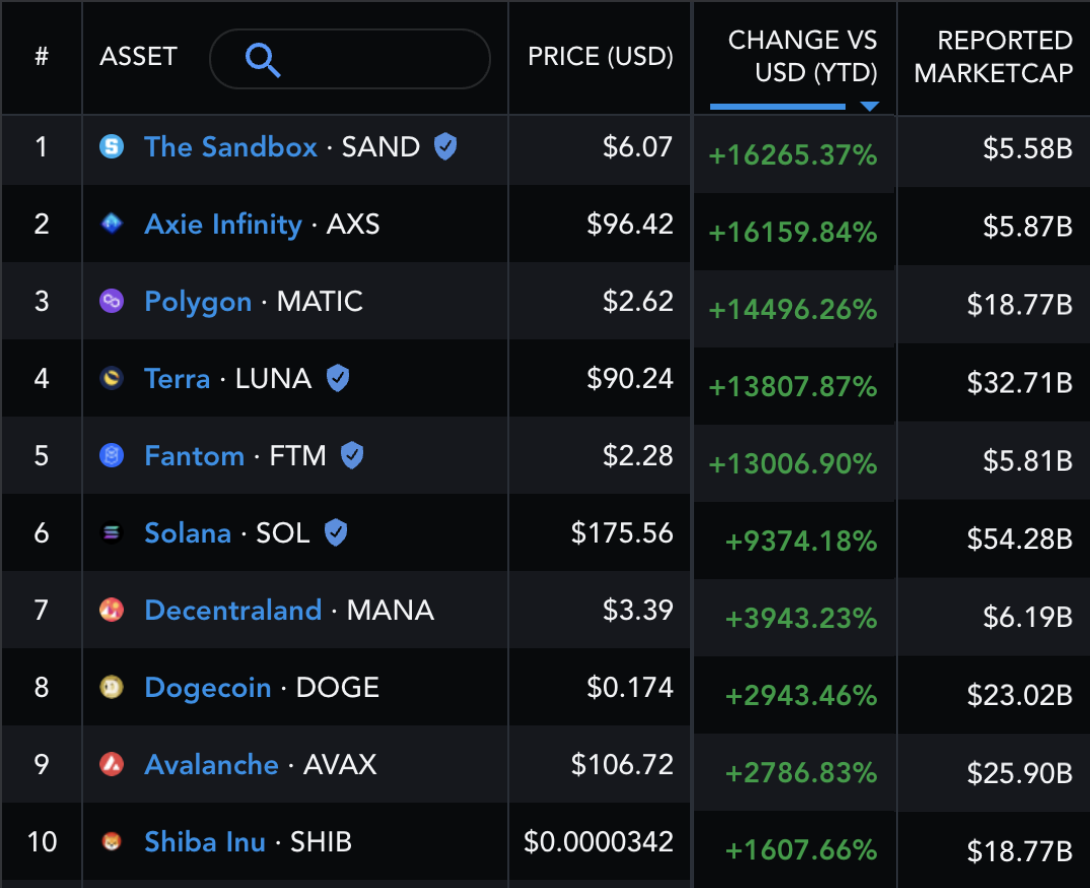

Top 5 Crypto Assets to Invest In:

Cryptocurrency is a form of digital currency that is created and managed through the use of advanced encryption techniques known as cryptography. Cryptocurrency has become increasingly popular in recent years, with many investors looking for ways to diversify their portfolios and increase their returns. With so many different cryptocurrency options on the market, it can be difficult to decide which assets to invest in. To help you make your decision, we’ve put together a list of the top five crypto assets that you should consider investing in.

1. Bitcoin (BTC): Bitcoin is the most well-known and widely traded cryptocurrency in the world, making it an ideal choice for those just getting started with cryptocurrency investing. It’s also considered to be one of the most secure forms of money, thanks to its decentralized network and encryption technology that safeguards against fraud and theft.

2. Ethereum (ETH): Ethereum is a platform that enables developers to create decentralized applications (dApps) using blockchain technology. It’s one of the most popular choices for creating smart contracts and decentralized finance applications due to its flexibility and scalability.

3. Litecoin (LTC): Litecoin is a peer-to-peer digital currency designed to be an easier way to send payments around the world than traditional banking systems. Its faster transaction times make it ideal for daily transactions such as paying bills or buying groceries online without having to wait days or weeks for a payment confirmation from your bank account.

4. Ripple (XRP): Ripple is a real-time gross settlement system designed specifically for banks and other financial institutions looking for cost-effective solutions when transferring large amounts of money between countries or currencies quickly and securely. As such, it has become one of the preferred options among major banks worldwide looking for international money transfers solutions due its speed and low transaction costs compared to traditional banking systems..

5. EOS: EOS is an open source blockchain platform based on delegated proof-of-stake consensus mechanism that provides support for dApps development similar to Ethereum but with improved scalability performance thanks its asynchronous communication protocol design architecture . EOS token holders have voting rights within its ecosystem which makes them part owners in all projects developed on top of this platform thus giving them access potential additional rewards from these activities .

Bitcoin (BTC)

Bitcoin is a revolutionary digital currency that has taken the world by storm. It was created in 2008 by an unknown person or group of people under the pseudonym Satoshi Nakamoto and released as open-source software. Bitcoin works on a decentralized network, meaning it’s not controlled by any single entity such as a government or central bank.

The idea behind Bitcoin was to create a digital currency that could be used like regular money but without needing to trust any third parties or go through the hassle of traditional banking systems. Transactions are sent directly between users and verified using powerful cryptography. All transaction data is stored on a public ledger called the blockchain, which prevents double spending and ensures that all transactions are secure and transparent.

Since its conception, Bitcoin has become increasingly popular with investors, merchants, and everyday people looking for an alternative way to store value and make payments online. Its unique features have made it one of the most sought-after investments in recent years, with some predicting its price will continue to rise over time.

Bitcoin can be bought, sold, traded, mined, loaned out against other currencies or assets and even used as collateral for loans — making it one of the most versatile investment vehicles around today. Its decentralized nature also makes it immune to government interference or manipulation — something that traditional currencies can’t claim.

Overall, Bitcoin offers users an innovative way to interact with financial markets without needing to use traditional banking systems or institutions — giving them more control over their finances than ever before!

Ethereum (ETH)

Ethereum (ETH) is a blockchain-based, open-source, distributed computing platform and operating system featuring smart contract functionality. It supports a modified version of Nakamoto consensus via transaction-based state transitions. Ethereum was developed by Vitalik Buterin in 2013, and is the second largest cryptocurrency by market capitalization after Bitcoin.

Ethereum has been designed to provide developers with the ability to create decentralized applications (dapps) that run on its own blockchain network. These dapps are powered by Ethereum’s native cryptocurrency, Ether (ETH). The purpose of Ethereum is to enable developers to build and deploy decentralized applications without any third-party interference such as censorship or fraud. This makes it an ideal platform for developers who want to develop innovative applications that have no central point of failure and use digital currency as a means of payment.

The primary feature that makes Ethereum stand out from other cryptocurrencies is its Smart Contract technology which allows users to write self-executing code that runs on the Ethereum Virtual Machine (EVM). Smart contracts are used in various industries including finance, healthcare, supply chain management, insurance, real estate and gaming. As these contracts are executed on the blockchain they offer increased transparency since all transactions are recorded immutably on the public ledger. Additionally, using smart contracts eliminates third parties such as lawyers or financial institutions which significantly reduces costs associated with traditional contract execution methods.

Finally, Ethereum offers its users access to Decentralized Autonomous Organizations (DAOs), which act as autonomous entities running entirely on code written into their respective smart contracts. A DAO can be programmed to carry out specific tasks autonomously without needing human intervention or control. This provides users with additional autonomy over their funds while making them less vulnerable to hackers or malicious actors seeking access to funds stored within a DAO’s domain.

In summary, Ethereum offers many advantages over traditional systems due to its secure infrastructure and Smart Contract technology allowing users more freedom over their data while reducing transaction costs while providing them with greater autonomy than ever before possible in conventional systems.

Ripple (XRP)

Ripple is a digital currency, created in 2012 by tech startup Ripple Labs. It is based on an open source protocol and can be used to send money across the globe quickly and securely. Unlike Bitcoin and other cryptocurrencies, Ripple does not rely on blockchain technology. Instead it uses its own proprietary technology, called Ripple Protocol Consensus Algorithm (RPCA), which allows users to transfer funds from one account to another without relying on a third party or middleman.

Unlike traditional currencies, Ripple does not require miners to confirm transactions; instead, it relies on consensus among its network of validating servers to reach agreement about the validity of each transaction. This helps ensure that transactions are secure and quick—a single transaction can be completed in about four seconds! The goal of Ripple is to become a global settlement network that facilitates real-time transfers between any two parties in the world.

The main benefit of using Ripple compared to other cryptocurrencies like Bitcoin is its speed—transactions take mere seconds as opposed to minutes or hours with Bitcoin, allowing users more flexibility with their funds. Additionally, it requires significantly less energy than Bitcoin mining because there are no miners involved in verifying transactions. And since all transactions are validated by validators within the system itself, there is no need for trust between different parties, making the system secure and reliable.

Overall, Ripple has some major advantages over other forms of currency: it’s fast and reliable while also being secure and cost-effective when compared to traditional banking systems. With these features combined with its user-friendly design and potential applications for international payments, Ripple could very well revolutionize how we make payments globally!

Litecoin (LTC)

Litecoin is a cryptocurrency that has been around since 2011, and it has become one of the most popular digital currencies. It was created by Charlie Lee, a former Google employee and MIT graduate, who wanted to create a “lite” version of Bitcoin.

Unlike Bitcoin, Litecoin can be mined using consumer grade hardware. This means that anyone with an average computer can mine Litecoin without having to invest in expensive mining rigs or ASICs. This feature makes Litecoin more attractive for those who are new to cryptocurrencies or don’t have the resources to invest heavily in mining operations.

In addition to being easier to mine than Bitcoin, Litecoin also has faster transaction times – typically 2 minutes instead of 10 minutes for Bitcoin – which makes it more suitable for everyday transactions. As such, many merchants have begun to accept Litecoin as payment for goods and services.

Like other cryptocurrencies, Litecoin is decentralized which means it operates on a peer-to-peer network and isn’t controlled by any government or central authority. This means that transactions are secure and anonymous (although some exchanges may require identification).

Overall, Litecoin is an attractive option for those looking to enter the world of cryptocurrency due its ease of use compared to other cryptos like Bitcoin and its faster transaction times. Additionally, with its lower mining requirements it may be more accessible for those who don’t want to invest heavily in their own mining rigs or ASICs right away but still want to get involved in cryptocurrency trading.

Binance Coin (BNB)

Binance Coin (BNB) is the cryptocurrency of the Binance exchange platform. It was created to facilitate trading activities on the Binance Exchange and used as a form of payment for transaction fees incurred on the platform. The BNB coin was launched in July 2017 through an Initial Coin Offering (ICO).

The primary purpose of BNB is to be used as a medium of exchange within the Binance ecosystem. This means that users can use it to pay for trading fees, listing fees, and other related services on the exchange. Additionally, users can also use it for payments at select merchants who accept it. One of the main advantages of using BNB is that it offers discounts on transaction fees when used for trading and other services on the platform; this makes it an attractive option for both new and seasoned traders alike. As such, many traders have taken advantage of this feature by holding substantial amounts of BNB in their wallets.

In addition to its utility within the platform, many investors have seen value in holding onto BNB tokens due to its potential appreciation in value over time. This has been driven by both speculation from investors looking to take advantage of short-term gains and by fundamental factors such as increased user adoption and adoption by larger companies like Microsoft Azure which recently added support for payments with certain cryptocurrencies including BNB. With these developments, demand for BNB tokens has grown significantly over time making them a viable investment option in their own right!

Overall, Binance Coin (BNB) is an attractive cryptocurrency asset due to its utility within the platform as well its potential appreciation value over time making it an ideal choice for both traders looking to reduce costs and investors seeking long-term returns from their portfolio.

Conclusion: Which Crypto will Explode in 2021?

The cryptocurrency market is an ever-evolving beast, and predicting which coins will explode in 2021 is a tricky endeavor. With more public awareness of cryptocurrencies, there are now many more investment options available than ever before. While it is impossible to know for certain which crypto will have the biggest explosion in 2021, there are some trends that can help investors identify potential candidates.

First, any cryptocurrency that has seen a significant price increase over the past few years has a good chance of continuing its upward trajectory in 2021. Coins like Bitcoin and Ethereum have set the bar for long-term success, so any coin that has been able to maintain or even build upon their gains could be considered a safe bet. Additionally, coins with innovative technology or unique use cases may also experience explosive growth this year as investors look for opportunities outside of the top two coins.

It’s also important to keep an eye on projects that have recently launched or are preparing to launch in 2021. These new entrants into the crypto space often bring with them exciting new features or applications that can cause prices to skyrocket if adopted widely by users. Investors should also pay attention to any upcoming developments such as hard forks or mainnet launches that could potentially fuel price increases.

Finally, it’s always wise to diversify your portfolio across multiple coins and tokens in order to hedge against potential losses from one asset while still allowing you to capitalize on any explosive gains from another asset. By spreading your investments out across different asset classes, you’ll be better prepared for whatever happens in 2021 and beyond!