Maximizing Gains and Minimizing Losses: Uncovering the Potential of Cryptocurrency in 2022

Maximizing Gains and Minimizing Losses: Uncovering the Potential of Cryptocurrency in 2022

Overview: The Potential of Cryptocurrency in 2022.

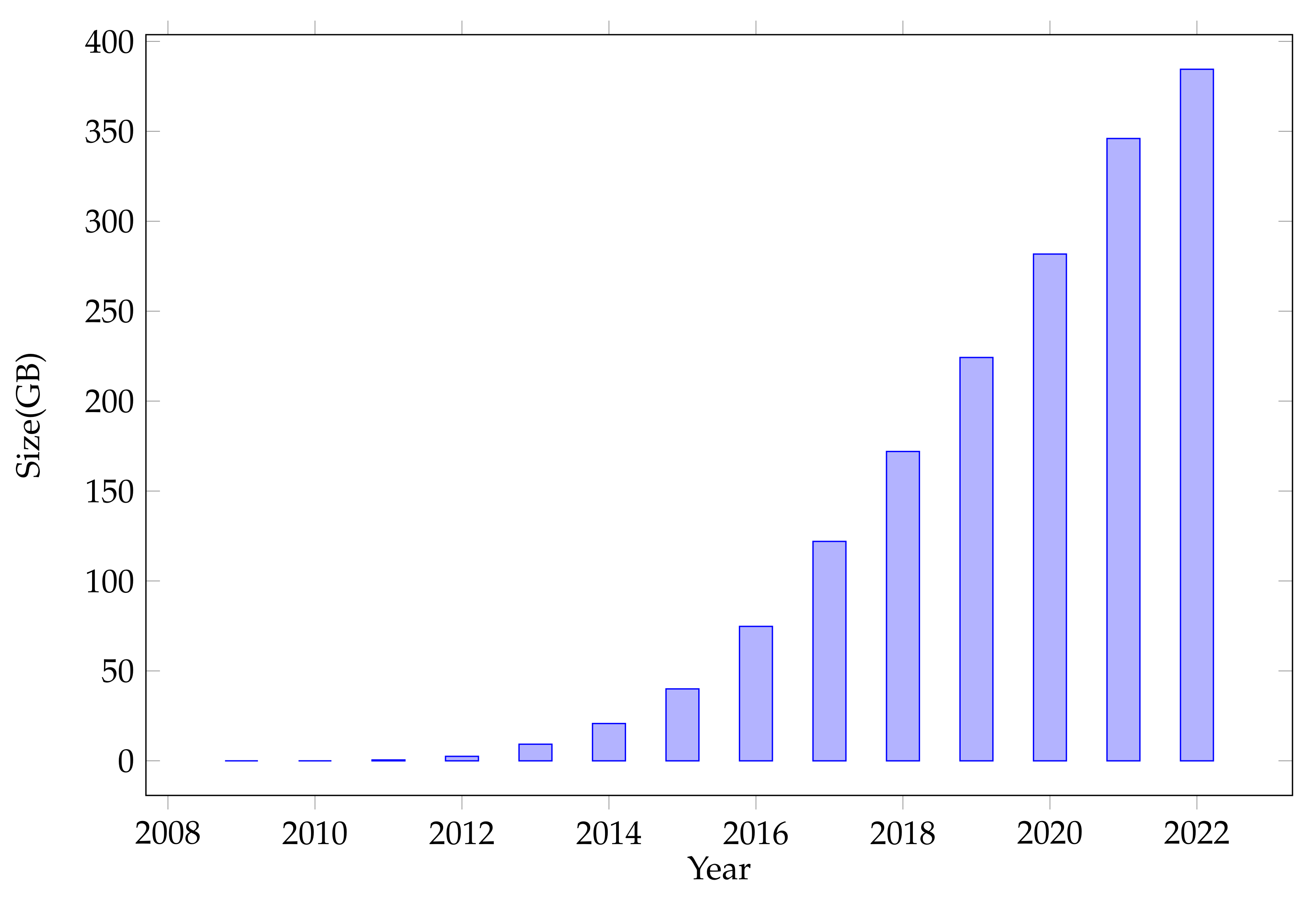

Cryptocurrency has been around since 2009, when Bitcoin was first introduced to the public. Since then, it has become a worldwide phenomenon, with many investors and financial experts predicting that cryptocurrency will continue to grow in 2022 and beyond. This article will explore the potential of cryptocurrency in 2022, highlighting its advantages and potential uses.

The Advantages:

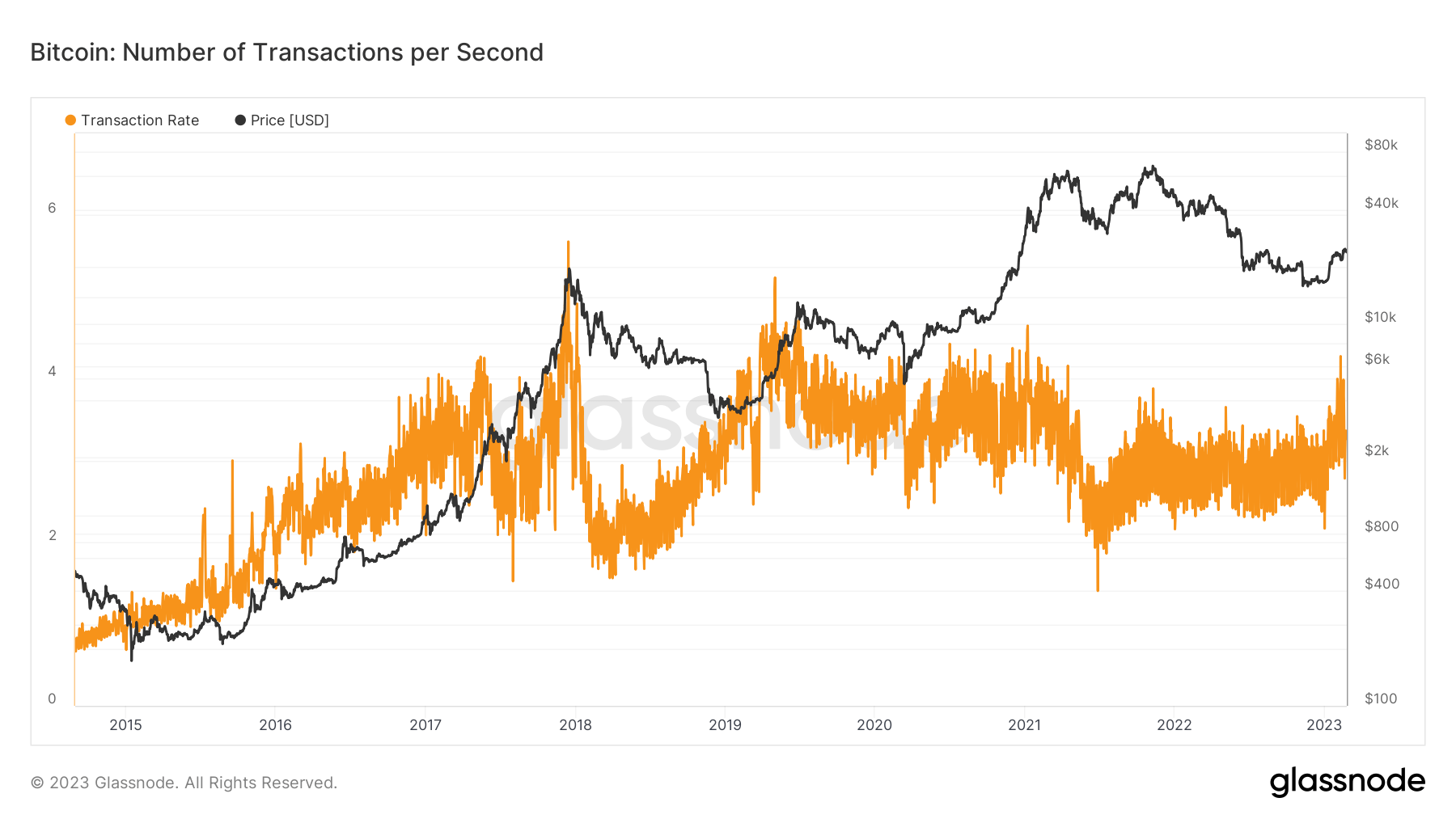

First off, cryptocurrency is incredibly secure. Due to its decentralized nature, transactions are processed quickly and securely without interference from third-parties or government regulations. The blockchain technology that backs up most cryptocurrencies also ensures that transactions remain private and anonymous. This means that users can trust their money is safe when using cryptocurrency for payments or investments.

Another advantage of cryptocurrency is its portability and flexibility in terms of payment options. Unlike traditional methods such as cash or credit cards, users can send funds anywhere in the world almost instantly with minimal fees compared to other payment solutions like bank transfers or PayPal. Additionally, crypto users don’t need to worry about exchange rates as most coins are traded against each other on global exchanges like Binance or Coinbase Pro.

Finally, cryptocurrency offers numerous investment opportunities for those looking to diversify their portfolios and reap the benefits of digital assets such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC) and more. With the rise of decentralized finance (DeFi) projects like Uniswap providing access to high-yield returns on crypto assets, this makes investing in digital currencies an attractive option for those looking for alternative income streams outside of traditional stocks and bonds markets.

The Potential Uses:

As we move into 2022, there are many potential uses for cryptocurrencies that could revolutionize various industries both online and offline:

– Payments : As mentioned before, one of the main advantages of cryptocurrencies is its ability to facilitate fast payments anywhere in the world with low transaction fees – making it ideal for international remittances or online purchases from overseas merchants who may not accept local forms of payment such as credit cards or fiat currency transfers due to higher processing costs associated with them..

– Trading : Cryptocurrencies have become popular among traders due to their volatility which allows investors to make quick profits from price movements based on market news events or technical analysis signals provided by trading platforms like eToro or Plus500..

– Investing : Cryptocurrencies also offer a wide range of investment opportunities outside traditional asset classes such as stocks/bonds/commodities etc., allowing investors access to high yields returns from new projects within the DeFi sector including yield farming & liquidity mining activities which can be accessed easily via wallets like Metamask..

– Security : Finally, cryptocurrencies offer improved security over traditional banking methods because all transactions are encrypted meaning they cannot be tampered with by malicious actors trying to steal user funds..

Conclusion:

To conclude, it’s clear that there are plenty of reasons why cryptocurrency could be a game changer in 2022 if used correctly – offering greater security than traditional banking solutions while providing flexible payment options & lucrative investment opportunities through decentralized finance projects & trading platforms alike! With continued growth predicted throughout 2021-2022 leading up towards mainstream adoption; only time will tell what lies ahead for this revolutionary technology!

Benefits of Crypto Trading: How to Maximize Your Returns.

Cryptocurrency trading is becoming increasingly popular as more and more investors turn to the digital asset class to diversify their portfolios. With the rise in popularity of cryptocurrencies, many investors are now turning to crypto trading for its potential profitability.

Crypto trading offers a number of advantages that are attractive for both novice and experienced traders alike. Here we will explore some of those benefits and how you can maximize your returns from crypto trading.

One of the main advantages of crypto trading is that it’s relatively low cost compared with traditional stock market investing. As there are no brokers or commissions involved, traders can enter and exit positions at minimal cost, providing them with greater flexibility than other forms of investment. Additionally, traders benefit from the fact that cryptocurrency markets never close; they are open 24 hours a day, 7 days a week, allowing traders to take advantage of price movements around the clock.

Another key benefit of crypto trading is its high liquidity levels. The large market capitalization ensures that buyers and sellers are easily able to find counterparties for their trades quickly and without large spreads in prices between exchanges. This makes it much easier for traders to access deep pools of liquidity when entering or exiting positions on any given exchange.

The decentralised nature of cryptocurrency markets also means that they are largely free from external interference such as government regulation or manipulation by central banks or financial institutions – something which cannot be said for traditional markets such as stocks, bonds or commodities which have often been subject to price manipulation over time by powerful organisations or individuals with vested interests in doing so.

As well as offering greater freedom than other forms of investment, cryptocurrency markets offer tremendous potential profits due to their volatility; rapid changes in prices can lead to significant profits if entered into carefully-managed positions at the right time – something which has attracted thousands of traders looking for quick returns on their investments!

However, it’s important to remember that whilst potentially lucrative opportunities exist within the cryptocurrency space there is also substantial risk associated with overly aggressive strategies such as margin trading (trading using borrowed funds), leveraged products (which amplify gains but also losses) and algorithmic/automated trading systems (which rely on complex computer algorithms). Therefore it’s essential that all prospective traders conduct extensive research into potential trades before entering into any position – understanding both current market conditions and likely future trends is essential if one wants to maximise profits whilst minimizing risks in this fast-moving market environment.

Finally, one should always keep an eye on news related developments within the industry – whether regulatory updates or technological advances – as these can often have an immediate impact on price action across different exchanges making staying up-to-date absolutely essential if one wants to remain ahead in this ever-changing landscape!

Risk Management Strategies: Minimizing Losses While Maximizing Gains.

Risk management is an essential part of any successful business. It involves identifying, assessing, and managing potential risks in order to minimize losses while maximizing gains. This process can be broken down into three main steps: identification, assessment, and management.

Identification is the first step in risk management. It involves recognizing potential risks that may affect a business’s operations or bottom line. These risks could include legal liabilities, natural disasters, market fluctuations, customer service issues, or anything else that could have a negative impact on the company’s finances or reputation. Once identified, these risks must then be assessed to determine their likelihood of occurring and the amount of damage they could cause if they do occur.

The second step in risk management is assessment. This entails evaluating each risk based on its probability of occurrence and the magnitude of the expected loss if it were to happen. Companies must also consider how much they are willing to invest in mitigating these risks and how much they are willing to accept should a risk materialize. Once this information has been gathered, businesses can decide which strategies to implement for minimizing losses while maximizing gains.

The third step is management; this includes taking proactive measures such as purchasing insurance policies and establishing contingency plans like backup systems or alternative suppliers in case something goes wrong with the original plan. Additionally, companies should ensure all personnel are aware of their responsibilities when it comes to risk management by providing training sessions on related topics like safety protocols or cyber security measures

In conclusion, risk management is an essential component for businesses looking to protect their investments and maximize profits over time. By understanding potential risks ahead of time through identification and assessment processes followed by effective management strategies such as purchasing insurance policies or establishing contingency plans; companies can minimize losses while maximizing gains from their operations

Choosing the Right Crypto Asset: Understanding Different Types of Cryptocurrencies.

Cryptocurrency is a rapidly growing asset class, and with that growth comes hundreds of different digital assets. With so many options, it can be difficult to know which cryptocurrency is the right fit for you. In this blog post, we’ll explore the different types of cryptocurrencies available in the market today and provide some tips on how to make an informed decision when investing in digital assets.

The main types of cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) and Stablecoins. Let’s take a look at each one:

Bitcoin (BTC): Bitcoin was the first digital currency created by Satoshi Nakamoto in 2009 and is often considered to be the gold standard of cryptocurrencies. It’s an open-source project developed by a decentralized network of volunteers and is powered by its own blockchain technology. Bitcoin has become extremely popular due to its potential for long-term growth, decentralization, irreversibility of transactions, and censorship resistance.

Ethereum (ETH): Ethereum is a public blockchain platform that facilitates smart contracts and applications such as decentralized finance protocols. Ethereum allows developers to create their own tokens and build apps on top of its blockchain infrastructure. The most well-known token associated with Ethereum is Ether (ETH).

Litecoin (LTC): Litecoin was created by Charlie Lee in 2011 as a faster alternative to Bitcoin with lower transaction fees. While it’s similar to Bitcoin in many ways, Litecoin has adopted new features like segregated witness technology which makes it more secure than other cryptoassets. Additionally, Litecoin offers faster transaction speeds compared to other digital currencies such as Bitcoin or Ethereum making it attractive for daily purchases or payments between individuals or businesses alike.

Ripple (XRP): Ripple is another popular digital asset designed for financial institutions looking for an efficient way to transfer money across borders at low cost with real-time settlement capabilities. Ripple also offers users access to liquidity pools where they can quickly exchange one currency for another without holding fiat currency reserves or needing third party exchanges like Forex markets do traditionally.

Stablecoins: Stablecoins are digital assets that are pegged 1:1 against specific fiat currencies such as US Dollars or Euros providing investors with price stability even during times of extreme volatility within the crypto markets. This type of cryptocurrency provides traders with easy access into traditional financial products while still allowing them exposure to cryptographic technologies like blockchain networks — making them ideal tools for hedging risk during periods of uncertainty among other things

Research & Analysis: Analyzing Trends and Evaluating Investment Opportunities.

Investing in the stock market can be a daunting task, especially for those who are new to it. It requires careful research and analysis of securities and markets in order to identify trends and determine which investments offer the best potential returns.

Research is the foundation of successful investing. Investors need to know what they’re buying, why they’re buying it, and how much risk they’re taking on. Without this information, investors are essentially flying blind – leaving themselves open to huge losses or missing out on major opportunities.

The first step in conducting research is performing an analysis of the specific security or sector you are considering investing in. This includes studying its historical performance (e.g., price movements, trading volume), researching its fundamentals (e.g., financial statements, management team), looking at analyst reports and ratings from reputable sources, evaluating macroeconomic factors that may affect it (e.g., interest rates), and assessing risk factors such as legal liabilities or government regulations that could impact its future prospects. All of this helps investors gain a better understanding of their target investments so they can make more informed decisions about whether or not to buy them.

Once you have a deeper understanding of your potential investment(s), the next step is to evaluate current market conditions and identify trends that may benefit your portfolio in the short-term or long-term. Technical analysis tools such as trend lines and chart patterns are useful for this purpose; however, fundamental indicators like earnings reports should also be closely monitored in order to gauge how different sectors might be affected by economic changes over time. Additionally, investors should pay attention to news outlets and other reliable sources for important announcements related to their target investments so they can react quickly when necessary.

By combining thorough research with thoughtful analysis of market conditions and trends, investors can make smarter decisions about which stocks will generate the highest returns over time – thereby helping them reach their financial goals faster than ever before!

Security Considerations: Protecting Yourself from Scams and Hacks.

In today’s digital age, scams and hacks are becoming increasingly common. Unfortunately, no one is immune from the potential risks associated with such threats. From large corporate organizations to individual users, everyone needs to take proper security measures in order to protect their personal information and assets.

The most important step you can take is to be vigilant when it comes to your online activities. Always keep an eye out for suspicious emails or websites that may contain malicious software or links. Don’t open emails from unknown sources, and don’t disclose your personal information on public networks or sites.

You should also make sure that your computer has up-to-date antivirus software installed on it at all times. This will help protect your system from known threats as well as any new ones that may arise in the future. Additionally, enabling two-factor authentication (2FA) is an excellent way of adding an extra layer of security to your accounts by requiring a second factor (such as a fingerprint scan) before allowing access.

Another way you can stay safe online is by using strong passwords for all of your accounts. Avoid using words or phrases that are easily guessed, such as birthdates or pet names—these can often be cracked with relative ease by hackers. Instead opt for a combination of upper and lowercase letters, numbers and symbols which will make it much harder for anyone attempting to gain access without permission.

Finally, always be aware of what you’re clicking on – even if it appears legitimate! It’s possible for scammers to use deceptive tactics such as spoofing links in order to redirect traffic away from genuine sites and onto malicious pages instead – so always double check the URL address before entering any sensitive information into any website form fields!

Staying vigilant about security doesn’t have to be difficult; just follow these simple tips and you should be able to avoid falling victim to scam artists and hackers alike!

Tax Implications: What You Need to Know Before Investing in Crypto.

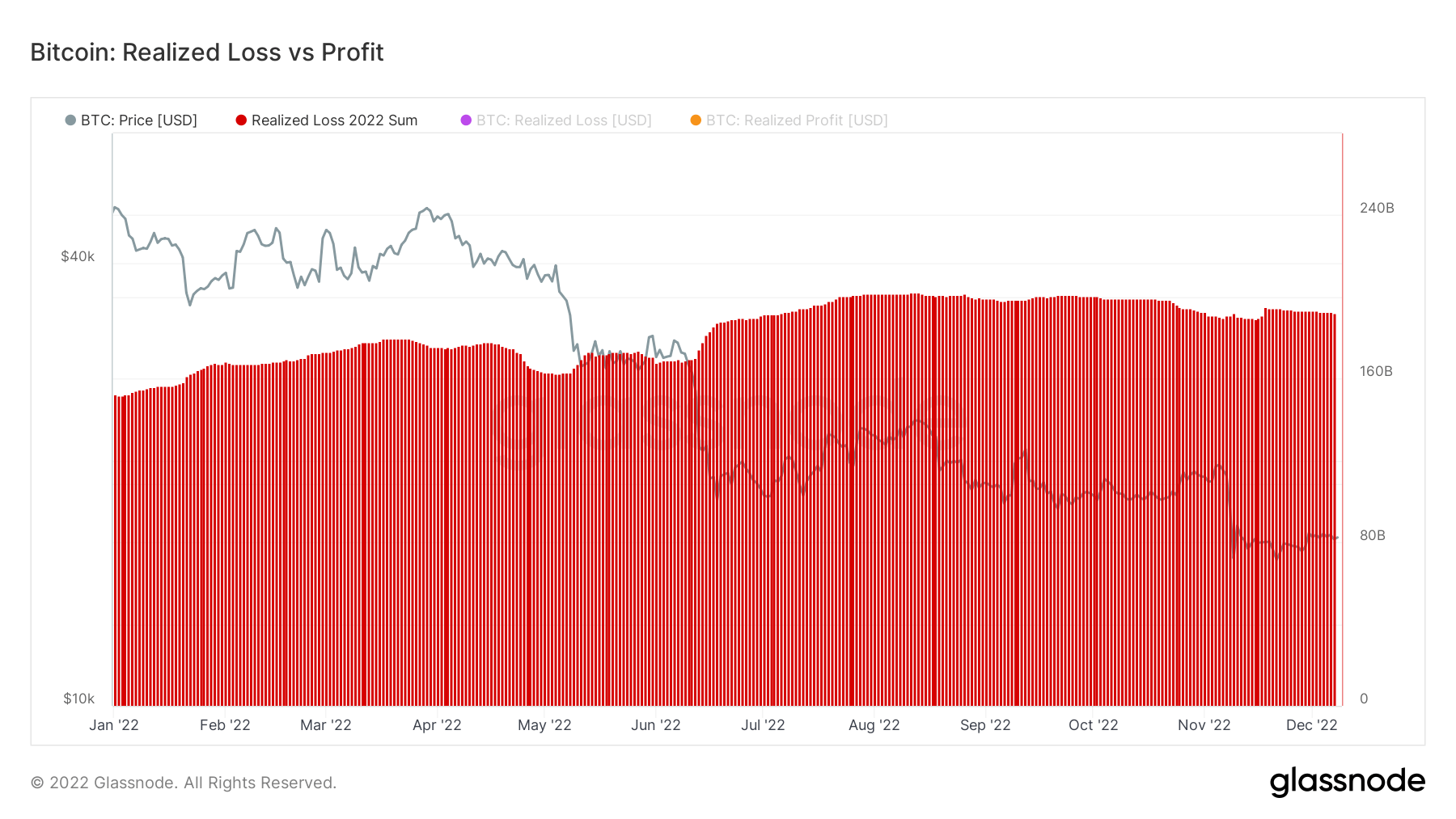

Cryptocurrency is one of the most exciting new investments out there – and it’s only getting bigger. But before you jump into investing in cryptocurrency, it’s important to understand the potential tax implications associated with this unique asset class.

In the United States, cryptocurrency is treated as property for tax purposes. This means that any gains or losses from trading or selling crypto are subject to capital gains tax. A basic understanding of how crypto is taxed will help you make more informed decisions about your investments and potentially save you money in the long run.

First, it’s important to note that only “realized” gains (i.e., profits from sales) are liable for taxation. So, if your crypto holdings increase in value but you don’t sell them, you won’t owe taxes on those unrealized gains until they become realized by a sale.

When calculating your taxable gain, you must subtract your cost basis — essentially what you paid for the investment — from the fair market value at which it was sold. For example: if you bought a coin worth $500 and then sold it when its value had increased to $1,000, your taxable gain would be $500 ($1,000 – $500). It’s also important to keep good records of all your transactions so that when tax season comes around you can accurately calculate your total taxable gain or loss.

It’s also important to know that short-term capital gains (profits made on assets held for less than one year) are taxed differently than long-term capital gains (profits made on assets held for more than one year). Short-term capital gains are usually taxed at higher rates than long-term ones; this means that if you buy and sell crypto quickly in hopes of making a profit off of price fluctuations, those profits may be subject to higher taxes than if you had held onto them longer term.

Finally, depending on where in the world you live and invest in cryptocurrency, it may be wise to consult with a qualified accountant about other applicable taxes such as income tax or VAT/GST (value added tax/goods & services tax). Different countries have different rules regarding how crypto is taxed so make sure to do some research before diving into investing!

At the end of the day, understanding taxation laws related to cryptocurrency can help ensure that investors maximize their returns while minimizing their liabilities come tax time.

Regulations & Compliance Issues: Understanding the Risks and Rewards for Investors.

Investing can be a great way to grow your wealth over time, but it also comes with risks. To help investors understand the potential rewards and risks of investing, it is important to understand the regulations and compliance issues that govern the industry. In this blog post, we’ll discuss what compliance issues mean for investors and why they are important to consider when making investment decisions.

The Securities and Exchange Commission (SEC) is responsible for regulating securities markets in the U.S., including stocks, bonds, mutual funds, options, futures contracts, commodities and derivatives. The SEC’s mission is to protect investors from fraud and other abuses in the marketplace by promoting transparency and fair dealing in securities transactions.

The SEC enforces a wide range of rules designed to ensure that investors have access to accurate information about investments so they can make informed decisions. These include disclosure requirements that require companies listed on stock exchanges to share detailed information about their finances and business operations with investors; insider trading prohibitions which prevent people with inside information from profiting unfairly by trading in stock; accounting standards which require companies to produce reliable financial statements; anti-fraud provisions which criminalize certain deceptive behavior; as well as other measures designed to protect investor interests.

Understanding these regulations is important for investors because it allows them to assess the potential risk associated with different types of investments. For example, if an investor buys shares of a company without fully understanding its financial disclosures or if they purchase securities from an unlicensed broker or dealer then they may be taking on additional risks that could result in financial losses or even criminal penalties in some cases. By understanding the laws governing securities markets, an investor can make more informed decisions about where and how to invest their money safely.

In addition to providing protection against fraud and other forms of abuse in the market place, compliance regulations also provide some benefits for investors such as greater transparency into corporate activities that helps them make more informed investment decisions. Moreover, regulatory oversight helps maintain orderly markets by ensuring fair pricing practices which benefits all participants involved – buyers get access to quality products at reasonable prices while sellers receive fair compensation for their products or services.

To summarize: Regulations & Compliance Issues are an important part of investing since they provide protections against fraud and abuse while also providing some benefits such as increased transparency into corporate activities that helps support more informed investment decisions. Understanding these rules can help ensure safer investments while still allowing you reap the rewards of investing over time!

Exchange Platforms & Brokerages: Selecting the Best Place to Buy, Sell, and Trade Cryptocurrency.

Cryptocurrency has become increasingly popular over the last few years, and as a result, there are now a variety of exchange platforms and brokerages that offer users the opportunity to buy, sell, and trade this digital asset. Making the right choice for your needs can be challenging; after all, it is important to select an exchange platform or brokerage that offers features you need for your trading strategy and investment goals.

When selecting an exchange platform or brokerage, two primary factors should be taken into consideration: fees and user experience. Different exchanges offer different fee structures; some charge transaction fees while others may require monthly subscription fees. It is also important to take into account user experience when selecting an exchange platform or brokerage – look for one with an intuitive interface that makes it easy to navigate and execute trades quickly.

Security is another important factor when choosing an exchange platform or brokerage. Make sure that the exchange or brokerage employs robust security protocols such as two-factor authentication (2FA) to protect user accounts from hackers. Additionally, it is worth taking time to research each platform’s reputation in order to ensure its legitimacy – read online reviews from past users so that you can make an informed decision on which platform best meets your needs.

Finally, remember to consider customer service when selecting an exchange platform or brokerage – look for one that offers reliable support in case you experience any technical issues while using their services. By following these tips and doing thorough research on available options before committing to a particular exchange platform or brokerage, you will be well on your way towards making the best choice for your cryptocurrency trading needs!

Technical Analysis Tools & Resources: Utilizing Charts, Indicators, and Models for Accurate Predictions.

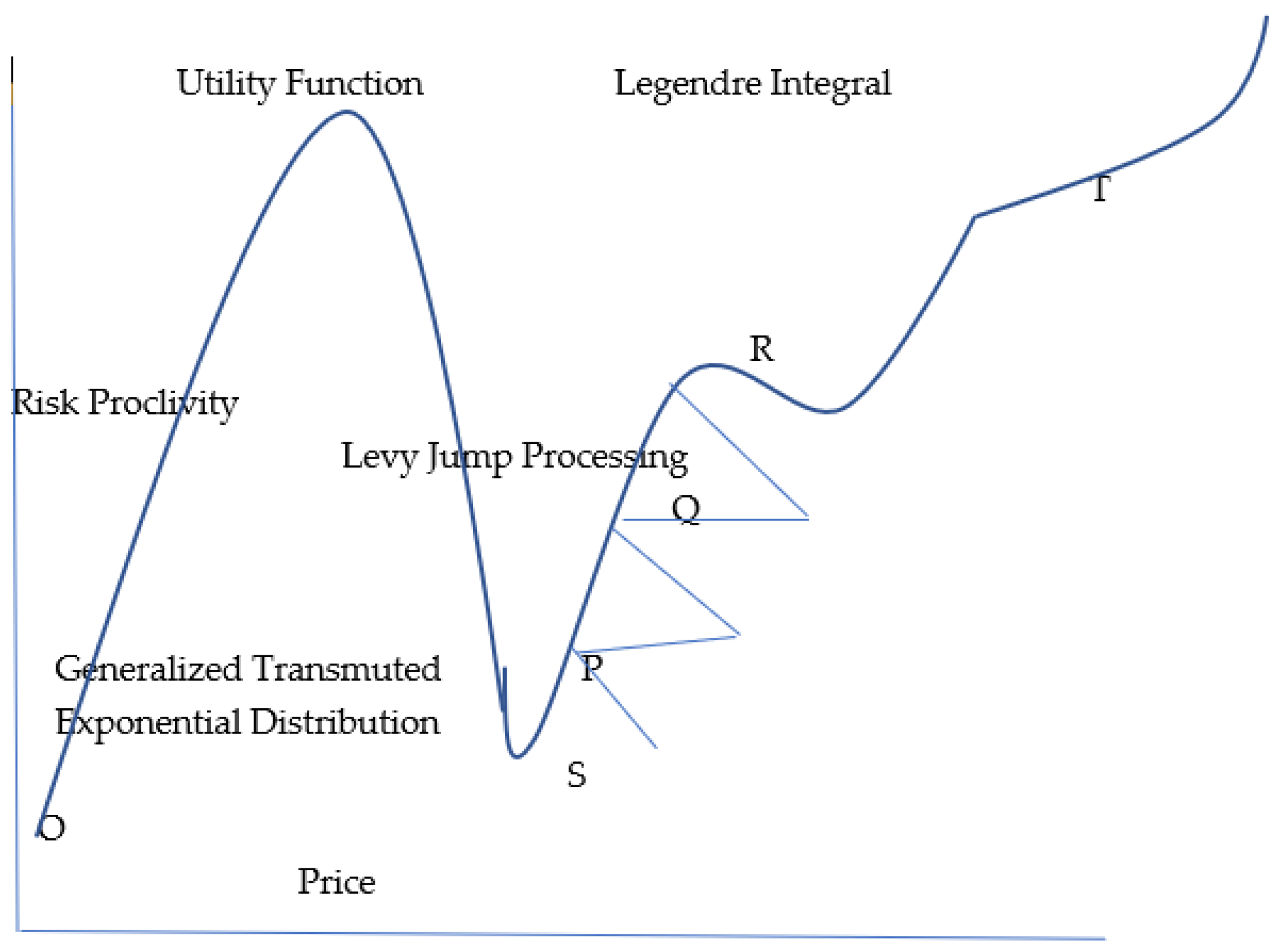

Technical analysis is an invaluable tool for investors, traders and brokers. It provides them with the ability to accurately predict future trends and prices in the stock market. Technical analysis involves studying historical data such as price movements, volume levels, momentum, and other factors to identify patterns that may be indicative of future changes in the markets. By understanding these patterns, investors can make more informed decisions when it comes to buying and selling stocks.

The primary tools used in technical analysis are charts and indicators. Charts map out past price action while indicators provide a view of current market conditions. These two elements combined can give investors a better idea of what might happen in the future. For example, a chart showing a stock’s price over time can help identify potential support or resistance levels that may impact its future price action. Similarly, indicators such as moving averages or oscillators can be used to determine whether the overall trend of a stock is bullish or bearish.

In addition to charts and indicators, technical analysts also use various models for forecasting purposes. One popular model is Elliott Wave theory which uses Fibonacci retracements to identify repeating patterns in price movements that suggest where prices will go next. Other models such as Dow Theory or Gann Theory aim to identify larger trends based on the collective movements of different index components or specific stocks within an industry group respectively.

Overall, technical analysis provides investors with invaluable insights into possible future market conditions allowing them to make more educated investment decisions accordingly. By utilizing charts, indicators and models correctly together they are able to accurately predict which way prices might move next giving them an edge over other investors who don’t have access to this information. With the right tools at their disposal anyone can become a successful trader so long as they understand how these tools work and how best to apply them for maximum returns!

Strategies for Successful Trading: Learning to Spot Trends, Manage Risk, and Execute Trades Successfully.

Trading in the financial markets can be an intimidating endeavor. With so many variables, it’s hard to know where to start and what strategies will work best. Fortunately, there are some key concepts that can help traders develop a successful trading plan. By understanding how to spot trends, manage risk, and execute trades effectively, traders can increase their chances of success in the markets.

Trends are one of the most important factors for successful trading. Trends represent the general direction of a security or market over a certain period of time. By spotting trends early on, traders can enter into positions before prices move too far in either direction. This allows them to take advantage of potential profits without exposing themselves to too much risk. Spotting trends also requires being aware of economic news and events that may affect market movements. Keeping up with news releases and economic data can help traders anticipate changes in asset prices before they happen.

Risk management is another important element when it comes to successful trading strategies. Risk management involves assessing the amount of risk involved with each trade and setting appropriate stop-loss levels. Stop-losses are predetermined points at which a trader will close out their position if price moves against them by a certain amount; these orders help limit losses if the market moves against you unexpectedly. Setting stop-losses also helps keep emotions out of trading decisions; if you have predetermined when you will exit your position regardless of further price action, you won’t be tempted to stay in too long or exit too soon due to fear or greed respectively.

Finally, executing trades properly is critical for successful trading strategies as well. When placing orders, it’s important to use proper order types such as limit orders versus market orders; limit orders allow you to set an entry point at which your order will be filled but not exceed your desired price level while market orders are executed immediately at whatever current price is available on the exchange (which could result in higher execution costs). Additionally, using proper risk-reward ratios when entering into trades can help improve overall returns; this means taking positions that have more potential profit than potential loss relative to their entry point (i..e risking $1 for every $2 expected profit). By understanding these three simple yet powerful concepts—trends, risk management, and proper execution—traders can greatly increase their chances of success in the markets!

Community Resources & Support Networks: Connecting with Other Investors to Leverage Knowledge and Insights.

Investing in the stock market can be a challenging task, particularly for those new to the game. With so much information out there, it can be tough to know what is true and what is not. This is why having access to a wide variety of resources and support networks can be so beneficial when investing. By connecting with other investors, you can leverage their knowledge and insights to make more informed decisions.

One of the best places to start is by visiting online investment forums. These are great resources for learning about different strategies, hearing other peoples’ experiences, and getting advice on specific stocks or sectors. Forums also provide an opportunity to ask questions and get answers from experienced investors who have already been through the process before you.

You should also consider joining local investor groups in your area. Most of these groups meet at least once a month and provide members with access to industry experts who can share their knowledge about stocks, bonds, mutual funds, ETFs, commodities markets, etc., as well as answer any questions that you may have about investing in general. Many of these groups also offer educational seminars that cover topics such as risk management and portfolio diversification. In addition to offering valuable advice from professionals in the field, investor clubs are great places for networking with like-minded individuals who may eventually become potential business partners or clients down the road!

Finally, don’t forget about social media platforms like Twitter and LinkedIn! While they might not seem like traditional “investment” tools at first glance, they are actually great ways to stay up-to-date with news related to your chosen sector(s) as well as connect with other investors who share similar interests or strategies. For example: if you invest primarily in tech startups then following relevant hashtags on Twitter will help keep you clued into new developments in this space while allowing you interact directly with founders/CEOs of these companies or venture capitalists interested in funding them – something which would otherwise be difficult without a platform like Twitter!

Ultimately, no matter what type of investor you are – beginner or seasoned pro – taking advantage of community resources & support networks is one of the best ways to ensure success when investing in the stock market. Doing so will give you access to more information than ever before which should ultimately lead to better decision making and higher returns over time! So start exploring today – who knows where it might take you?!

Conclusion: Taking Advantage of the Potential of Cryptocurrency in 2022

Cryptocurrency has been around for a few years now, and while it hasn’t yet reached mainstream adoption, the potential is certainly there. In 2022, cryptocurrency could be poised to become even more widely accepted and used by individuals, businesses, and governments alike. The key to taking advantage of this potential lies in understanding how cryptocurrency works and embracing the technology that powers it.

At its core, cryptocurrency is digital money that exists outside of traditional banking institutions. It is secured using cryptography and can be exchanged for goods or services without any third-party involvement. This makes it faster, cheaper, and more secure than traditional methods of payment. Cryptocurrency transactions are also immutable – meaning they cannot be altered or reversed – providing an additional layer of security for users.

The most popular form of cryptocurrency is Bitcoin (BTC). While other digital currencies exist, Bitcoin is by far the most widely adopted and accepted form of cryptocurrency today. It’s also the most secure since it’s underpinned by a blockchain network that utilizes advanced cryptographic algorithms to ensure its integrity. By 2022, Bitcoin may well become one of the most trusted forms of payment globally due to its increased security measures compared to traditional currency systems.

In addition to Bitcoin, several other cryptocurrencies have gained traction in recent years as well. Ethereum (ETH) is one such example; ETH allows developers to build decentralized applications on top of its blockchain network making it easier than ever before to create new projects with greater efficiency than traditional methods allow for. Litecoin (LTC), Ripple (XRP), Dash (DASH), Monero (XMR), Cardano (ADA) are all examples of altcoins – alternative coins to BTC – offering different functions or features that appeal to certain users over others’. As more people become aware of these altcoins’ advantages over BTC, their popularity will continue to grow in 2022 as well.

Finally, stablecoins offer another type of digital asset with their own advantages over conventional currencies such as fiat money. Stablecoins are designed specifically with price stability in mind; they are typically pegged 1:1 against a fiat currency such as USD or EURO so that their value does not fluctuate drastically like regular cryptocurrencies do when affected by market conditions or speculation from traders/investors alike. This makes them ideal for day-to-day transactions where maintaining a consistent price point is important; merchants can accept payments without worrying about volatility risk associated with other forms of digital money like BTC or ETH which experience significant price fluctuations due to their speculative nature in the markets they trade in daily basis..

By understanding how these technologies work together – blockchain networks coupled with smart contracts – businesses can take advantage of the potential offered by cryptocurrency in 2022 and beyond! Smart contracts enable parties involved in a transaction agreement to automate parts or all aspects thereof securely which helps reduce costs associated with manual labor while increasing accuracy overall when compared against conventional means such as paper agreements processed through lawyers etc… By utilizing this technology properly companies can save time & resources greatly reducing operational costs while creating trust between partners & customers alike thanks largely due decentralization provided by crypto networks mentioned above allowing everyone partaking within ecosystem access information stored within it easily & securely without having worry about malicious actors tampering data at any given time.. All these benefits combined make perfect sense why many organizations & individuals have embraced crypto solutions wholeheartedly during pandemic times we’re living currently showing world’s readiness transition away from legacy systems towards ones powered blockchain technology ushering new era financial freedom individual empowerment unlike anything seen before!