Unlock the Future of Cryptocurrency Markets: 2021 Trends, Investment Strategies, and Security Regulations

Unlock the Future of Cryptocurrency Markets: 2021 Trends, Investment Strategies, and Security Regulations

Market Overview:

Every business needs to stay ahead of the competition and be informed about the latest trends in their industry. To do that, it’s important to keep up with market overviews, which give businesses an idea of what is happening in their market and who their competitors are. Market overviews are essential for any business looking to succeed and grow. They provide an excellent source of information on current trends, changes in consumer behaviour, competitor actions and emerging opportunities.

A well-crafted market overview can help a business better understand the landscape they are operating in, identify areas where they can gain a competitive advantage and develop strategies to capitalize on those opportunities. It also helps managers make more informed decisions by providing them with data-driven insights into customer preferences, industry developments and other relevant topics. By taking the time to compile a comprehensive market overview, businesses can get a better understanding of their target customers and develop strategies that will help them capture more market share.

At the same time, it’s important for businesses not to overlook current competitors when conducting a market overview. Understanding what your competitors are doing – from pricing strategies to product offerings – can give you valuable insight into how best to position yourself against them. Doing so will allow you to differentiate yourself from the competition while also aligning your products or services with customer demand.

Finally, conducting regular market overviews should be part of every business’ strategy for success; this way you can stay abreast of changing customer preferences or new opportunities that might otherwise go unnoticed. Keeping up with these updates will ensure your business remains agile enough to compete effectively within its given marketspace.

Cryptocurrency Trends in 2021

Cryptocurrency is shaking up the world of finance in a big way, and 2021 is set to be a year of big changes. With the rise of digital currencies like Bitcoin, Ethereum, and others, it’s clear that cryptocurrency is here to stay. But what are some of the trends we should expect to see this year?

First off, we can expect an increase in institutional adoption of cryptocurrencies. Major financial institutions such as banks and investment firms have already started taking notice of digital currencies, with many now offering crypto trading services and custody solutions. We can also expect more hedge funds and other traditional investors to enter the fray in 2021.

Another trend that will likely continue is the rise in popularity of decentralized finance (DeFi). DeFi platforms allow users to lend and borrow digital assets without relying on centralized third parties like banks or brokers. This means lenders get higher returns on their investments while borrowers benefit from lower interest rates than those offered by traditional finance providers. As more people become familiar with DeFi protocols, usage will likely grow throughout 2021.

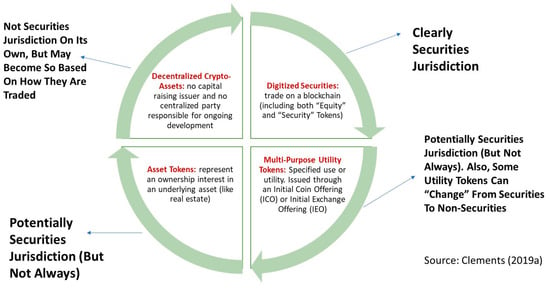

The regulatory landscape surrounding cryptocurrencies is also likely to evolve this year. Countries around the world are beginning to develop their own frameworks for regulating digital assets, which could open up new opportunities for businesses looking to launch tokenized products or services. At the same time, stricter regulations could create obstacles for companies operating within certain jurisdictions – so it’s important to keep an eye on any updates from governments and regulators moving forward.

Finally, we may see further development in terms of blockchain technology applications beyond just cryptocurrency transactions this year. Companies are already exploring ways to use distributed ledger technology (DLT) for various purposes including asset management, supply chain tracking, healthcare data storage – even voting systems! It will be interesting to see how these projects progress over the coming months as more organizations realize the potential benefits of DLT-based solutions.

Overall, 2021 looks set to be an exciting year for cryptocurrency – with plenty of new developments on both sides: technological advancements as well as regulatory changes that could affect how digital assets are used all over the world!

Forecasting the Future of Cryptocurrency Markets

Cryptocurrency markets have experienced remarkable growth over the past few years, and many investors are eager to know what the future may hold for these markets. While predicting the future of such a rapidly changing industry can be risky, there are some trends that we can observe to make informed decisions.

One key trend is the increasing interest from institutional investors. As cryptocurrency markets mature and become more regulated, large financial institutions will become increasingly comfortable investing in them. This could lead to huge gains for those who get in early, as well as a stabilizing influence on volatile market prices.

Another trend to watch is blockchain technology’s potential beyond cryptocurrencies. Blockchain technology has already been applied in other industries, including finance, healthcare, government and even music streaming services like Spotify. By leveraging blockchain technology in these areas, it could unlock new opportunities and open up innovative use cases that were previously impossible or too costly to implement.

The emergence of decentralized finance (DeFi) is another area of potential growth for cryptocurrency markets. DeFi allows users to access financial services without relying on traditional banking systems or middlemen like brokers or exchanges. These services include loans and investments that can be accessed directly through smart contracts on the Ethereum blockchain network – this opens up new possibilities for both individual investors and businesses alike.

Finally, it’s important to consider the impact of regulation on cryptocurrency markets going forward. Many governments around the world are beginning to take a closer look at how they can regulate crypto assets while still allowing innovation within their countries’ economies. This could provide more stability for investors by introducing measures such as tax breaks for those investing in cryptocurrencies or guidelines for how businesses should handle them legally.

Overall, cryptocurrency markets are still relatively young compared to traditional investment options but offer great potential rewards due to their volatility and high risk-reward ratio . With an ever-evolving landscape driven by new technologies , regulatory changes , and institutional investors , predicting the future of crypto markets is difficult but not impossible . By monitoring these trends closely , savvy investors can make informed decisions when it comes time to invest in this exciting asset class .

Types of Cryptocurrency:

Cryptocurrency has become increasingly popular in recent years, with many types of cryptocurrency appearing on the market. Cryptocurrency is a digital form of money that uses cryptography to secure transactions and control the creation of new units. There are several different types of cryptocurrency available, each offering its own unique features.

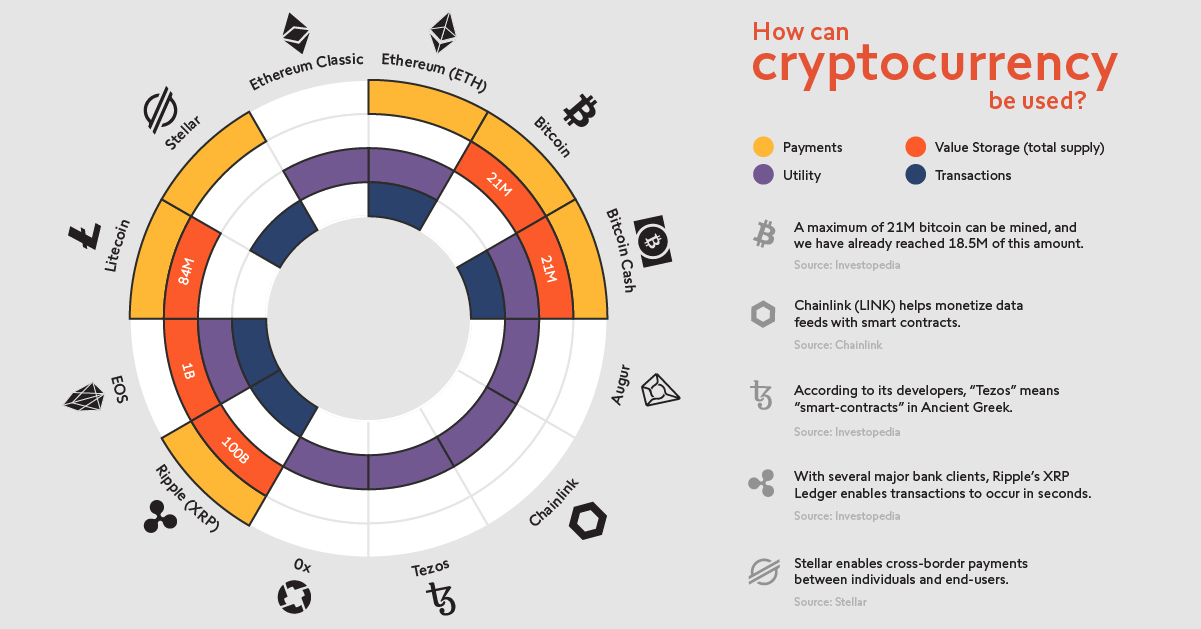

The most popular type of cryptocurrency is Bitcoin, which was created by an unknown person or group known as Satoshi Nakamoto in 2009. Bitcoin is based on blockchain technology and works much like traditional currency but without the need for banks or governments to oversee its use. Bitcoin can be used to purchase goods and services online, as well as being traded for other currencies around the world.

Another type of cryptocurrency is Ethereum, which was launched in 2015 by Vitalik Buterin and other developers. Ethereum works similarly to Bitcoin but also allows users to build and run decentralized applications (DApps) on its network using “smart contracts” written in its own language called Solidity. Ethereum also has its own token called Ether (ETH), which can be used to pay for transaction fees and other services within the network.

Ripple (XRP) is another popular type of cryptocurrency that was released in 2012 by Ripple Labs Inc., a US-based company founded by Chris Larsen and Jed McCaleb. Ripple works differently from other cryptocurrencies because it doesn’t require mining like Bitcoin does; rather, it uses a distributed ledger system similar to banks that allows transactions to be processed faster than with traditional payment systems. Ripple also offers low transaction fees compared to other cryptocurrencies and can be exchanged for more liquid assets such as USD or EUR quickly and easily.

Finally, Litecoin (LTC) is another type of cryptocurrency developed in 2011 by Charlie Lee, who was formerly an engineer at Google. Litecoin uses a different algorithm than Bitcoin called Scrypt which makes it easier for regular computers to mine coins instead of requiring specialized hardware like ASICs (Application Specific Integrated Circuits). It also has faster block times than Bitcoin allowing for quicker transaction confirmations as well as lower fees per transaction making it ideal for smaller payments or everyday purchases online..

No matter what type of cryptocurrency you decide on using there are some important things you should keep in mind before investing any money into them such as understanding how they work, researching their history/performance over time, keeping track of current prices/exchanges rates so you don’t overpay when buying or selling them, learning about storage options so your coins remain secure from hackers, etc… Ultimately though no matter what kind you choose make sure it’s something you feel comfortable investing into because once the money’s gone there won’t be any way get it back!

Bitcoin

Bitcoin is an innovative form of digital currency created in 2009 by an unknown programmer, or group of programmers, under the pseudonym Satoshi Nakamoto. As a decentralized form of currency, Bitcoin operates independently of central banks and governments – allowing it to be used for purchases anywhere across the globe without additional fees or restrictions.

Unlike traditional forms of money, Bitcoin is a purely digital asset that can be stored on computers and sent electronically between users, much like email. The Bitcoin system is also designed to verify each transaction with a secure cryptographic code that ensures all funds are sent and received accurately. This process makes it virtually impossible to counterfeit or double-spend.

The advantages of using Bitcoin over other payment methods are numerous – from low transaction fees and fast settlement speeds to increased security and privacy for users. With no middleman involved, transactions made with Bitcoin are not subject to third-party interference such as currency conversion fees or government regulations. Additionally, because Bitcoin’s ledger is publically available, users can track their transactions without fear of censorship or fraud – making it ideal for use in business dealings where trustworthiness is essential.

As more people become aware of its benefits, the demand for Bitcoin has grown exponentially over the years – leading to a surge in its value relative to other currencies. This rising popularity has also attracted the attention of investors looking to capitalize on its potential future growth – further driving up prices as well as increasing market volatility.

Despite this volatility, many experts believe that the technology behind Bitcoin will continue to improve over time — making it more reliable and secure than ever before — ultimately leading towards widespread adoption and usage around the world.

Ethereum

The world of blockchain technology is constantly evolving, and Ethereum has emerged as one of the most powerful and influential players in the space. Ethereum is a decentralized platform that runs smart contracts on a distributed network of computers. It allows developers to build applications without any middlemen or third-party interference. What makes Ethereum so revolutionary is its ability to execute “smart contracts” – programs that are programmed to run autonomously and securely on the blockchain. These smart contracts can be used for virtually any purpose, from financial transactions to voting systems.

Ethereum provides an open source platform for developers to build decentralized applications (dApps). DApps are applications that run entirely on a blockchain and can be used by anyone without needing permission from any central authority. They enable users to interact with each other directly, without relying on a centralized server or third party intermediary. This makes them incredibly secure and immutable, making them ideal for use cases such as digital identity management, asset ownership tracking, and financial services.

One of the most popular use cases for Ethereum is creating tokens which represent digital assets like currencies or loyalty points. These tokens are created using Ethereum’s programming language Solidity and deployed onto the network through an initial coin offering (ICO). ICOs have become very popular over the past couple of years as they allow businesses to raise funds quickly and efficiently while avoiding many of the traditional obstacles associated with venture capital funding. By leveraging Ethereum’s powerful smart contract capabilities, these projects can also ensure that investors are able to get their money back if certain conditions are not met during development.

In addition to ICOs, Ethereum also powers Decentralized Autonomous Organizations (DAOs), which are organizations built entirely on smart contracts with no human intervention required. DAOs can automate processes like governance decisions or fund distribution without relying on centralized control structures like banks or governments. This makes them highly efficient compared to traditional organizations since there’s no need for costly bureaucracy or layers of management oversight.

Ethereum has seen tremendous growth over the last few years due its flexibility and potential for innovation in many different industries beyond finance – including health care, gaming, legal services, energy trading, music streaming, supply chain management and more. As more developers discover its power and potential use cases emerge across various industries around the world – it’s safe to say that Ethereum will continue its ascent into becoming one of the most influential players in blockchain technology today!

Litecoin and Other Altcoins

Altcoins, or alternative coins, are digital currencies that are not Bitcoin. While Bitcoin is the most popular and well-known cryptocurrency on the market, there are hundreds of altcoins available today. Litecoin is one of the most widely used altcoins and has been around since 2011.

Litecoin was created as an alternative to Bitcoin with a few key differences. Unlike Bitcoin’s ten-minute block times, Litecoin has a two-and-a-half minute block time, allowing transactions to be confirmed more quickly. Litecoin also has a larger total supply than Bitcoin (84 million versus 21 million) and uses a different algorithm for mining (Scrypt). This makes it easier for new users to join the network without having to purchase specialized hardware for mining purposes.

In addition to being faster and easier to use than Bitcoin, Litecoin also offers lower transaction fees due to its increased liquidity in comparison with other altcoins. This makes it an ideal choice for merchants who need low cost transactions but want access to more features than those offered by traditional payment methods such as credit cards or PayPal.

Since its launch in 2011, Litecoin has become one of the top five cryptocurrencies in terms of market capitalization and continues to grow in popularity each day. Its increasing acceptance among merchants and users alike demonstrates that it is here to stay in the world of digital currency trading. With its low cost transactions, easy accessibility, and reliable security features, Litecoin is certainly worth taking a look at if you are considering investing in cryptocurrencies or just want another option for payments aside from fiat currency like USD or EURO

Investment Strategies:

Investing can be a powerful tool for building wealth, but it isn’t without its risks. Knowing the right strategies and being aware of potential pitfalls can help make sure that your investments pay off in the long run. Here are some tips to help you get started on building a successful investment strategy:

1. Have a plan: The first step to developing an effective investment strategy is to determine your overall financial goals. What do you hope to achieve with your investments? Do you want to generate income or build wealth? Once you have established these goals, you can develop an appropriate strategy.

2. Diversify: As the old adage goes, “don’t put all your eggs in one basket” – and this applies just as much to investing as it does anything else. Spreading out your investments across different asset classes, such as stocks, bonds, and real estate can reduce risk and provide greater returns over time.

3. Monitor Your Portfolio: It’s important to regularly monitor your portfolio and adjust it when necessary in order to stay on track with your financial goals. This means paying attention to changes in markets, economic conditions, and other factors that could affect the value of your investments so that you can make informed decisions about when and where to invest or sell off assets.

4. Use Tax-Advantaged Accounts: Taking advantage of tax-advantaged accounts such as 401(k)s or IRAs is one way to save money on taxes while also providing a secure retirement fund for yourself down the road. Contributing money into these accounts helps reduce taxable income today while giving you access to funds later down the line without having them taxed again when they are withdrawn..

5. Consider Professional Advice: If you feel uncomfortable investing on your own or don’t have enough time or expertise necessary for making sound decisions then seeking professional advice may be helpful option for you .Finding a qualified financial advisor who understands your specific needs can help guide toward making wise choices about investing for both short-term gains and long-term success.

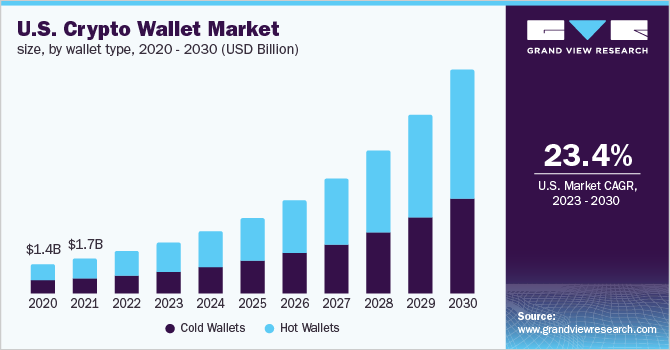

How to Invest in Cryptocurrencies

Investing in cryptocurrencies is becoming increasingly popular, as more and more people realize the potential for high returns and low risk associated with these digital assets. Cryptocurrencies are a relatively new asset class, so it’s important to understand the basics before you dive in. In this blog post, we’ll cover everything you need to know about how to invest in cryptocurrencies.

First off, it’s important to understand why cryptocurrencies have become so popular. Cryptocurrencies are digital assets that use cryptography to secure financial transactions and control the creation of new units of currency. This system is decentralized, meaning there is no central authority or government controlling the currency. This gives users greater control over their funds and provides an alternative way to store value outside of traditional banking systems.

The second thing to consider when investing in cryptocurrencies is which ones you should choose. There are hundreds of different coins out there, each one offering its own unique features and benefits. It’s important to do your research before investing in any particular coin, as some may be more volatile than others or offer different levels of security or privacy features than other coins do.

Once you’ve chosen a cryptocurrency (or multiple currencies) that you want to invest in, it’s time to decide how much money you want to put into it. Generally speaking, it’s best not to invest too much money into any one coin at first—start small and then build up your investments gradually over time as you become more comfortable with the asset class overall.

One final step before investing is making sure that the exchange or wallet platform where you plan on buying your cryptocurrency is safe and secure—look for reviews from other users and make sure that they have good customer service ratings before proceeding with a purchase.

By following these steps, anyone can get started safely investing in cryptocurrencies quickly and easily! Just remember: do your research beforehand, start small when making investments, choose a trustworthy platform for purchases, and always stay informed about changes in market conditions!

Risk Management for Crypto Investors

Cryptocurrency investing is a high-risk, high-reward endeavor, and investors must manage their risk appropriately to maximize potential gains while mitigating potential losses. Crypto investors should use a variety of strategies to mitigate risk, such as diversification, stop losses, and hedging. In addition to these traditional methods, investors can also take advantage of advanced tactics such as using derivatives or leveraging options contracts.

Diversification: One way to reduce risk is by diversifying your investment portfolio with different types of cryptocurrencies. This allows you to spread out the risk over multiple investments rather than having all your eggs in one basket. By investing in a variety of coins and tokens from different sectors and industries you can ensure that if one sector experiences a downturn the rest of your portfolio will remain relatively stable.

Stop Losses: Another effective strategy for managing risk is setting up stop loss orders on exchanges. A stop loss order is an instruction given to an exchange telling it to automatically sell off all or part of your holdings when they reach a certain price point. This helps protect you from major losses should the price of the cryptocurrency suddenly drop significantly.

Hedging: Hedging is another strategy used by crypto investors to manage their portfolios by offsetting potential losses with other assets or investments that have opposite prices movements. For instance, if you are long bitcoin but believe its value might fall soon, you could hedge against this scenario by shorting Ethereum or another altcoin that typically follows similar market patterns as Bitcoin does. That way if Bitcoin’s value does dip you will be able to make money off the Ethereum position instead of taking the full brunt of the loss on Bitcoin alone.

Derivatives: Derivatives are complex financial instruments that are used for speculative trading purposes and allow traders to speculate on future price movement without actually owning any underlying asset (such as cryptocurrency). Derivatives can be risky due their highly leveraged nature but used properly they can help traders hedge against risks associated with volatile markets while potentially increasing returns at the same time.

Options Contracts: Options contracts give buyers the right (but not obligation) to buy or sell an underlying asset at a predetermined strike price within a certain time period called expiration date. Options contracts provide investors with more flexibility than buying/selling directly on an exchange since they allow traders to take both bullish and bearish positions without actually owning any underlying asset – thus providing them with greater protection against downside risks associated with volatile markets while still allowing them potential upside profits should prices move in their favor

Security and Regulations:

When it comes to the digital world, security and regulations are of utmost importance. In this day and age, the internet has opened up a whole new realm of possibilities. Unfortunately, malicious actors have also taken advantage of this newfound freedom to wreak havoc on unsuspecting users. As a result, security and regulation have become essential components for any online business or website.

Security is key in protecting user data from unauthorized access, viruses, malware and other malicious attacks. This can be done through various means such as encryption technologies, firewalls and authentication protocols. Additionally, having secure systems in place can help protect against breaches with data breaches resulting in severe financial repercussions for businesses.

Regulations are also necessary when it comes to operating an online business or website. These regulations ensure that companies abide by certain standards when dealing with customers’ personal data as well as providing protection against fraudulent activities while conducting digital transactions such as credit card payments or e-commerce purchases. Adhering to these rules is important not only to keep users safe but also to ensure businesses remain compliant with applicable laws and regulations in their respective countries.

In conclusion, security and regulations are two key elements which must be addressed in order for an online business or website to remain successful over time. It is important that companies take the necessary steps to protect their customers’ data while ensuring their operations adhere to applicable laws and guidelines set forth by regulatory bodies around the world. By doing so, businesses can continue offering their services safely while keeping customers satisfied with their experience online.

The Challenges of Legally Operating a Crypto Exchange

Cryptocurrency exchanges are becoming increasingly popular as the demand for digital assets like Bitcoin, Ethereum and Litecoin continues to grow. As with any new industry, there is a wide range of legal implications to be considered before setting up a crypto exchange.

In order to ensure compliance with applicable laws and regulations, it’s essential that crypto exchanges understand the complexities of operating in this space. Here are some of the biggest challenges facing those looking to set up a cryptocurrency exchange:

1) Licensing Requirements: Depending on where you’re located, different licensing requirements may apply when launching an exchange. In some countries, such as the United States, exchanges need to register with both state and federal authorities. It’s important to research your local regulations carefully in order to ensure you make the right decisions when setting up your exchange.

2) Compliance Requirements: This is one of the toughest aspects of running a crypto exchange due to its complexity. Crypto exchanges must comply with anti-money laundering (AML), know-your-customer (KYC), and counter-terrorist financing (CTF) policies in order to protect customers from fraud or financial crime. It’s vital that exchanges have robust systems in place to adhere to these regulations or they could face hefty fines or even jail time if they don’t comply.

3) Security Protocols: Cryptocurrency exchanges handle large amounts of sensitive data which makes them prime targets for hackers and cyber criminals. It’s essential that all security protocols are followed strictly in order to keep customer information safe and secure at all times. This includes implementing strong authentication measures, using cutting edge encryption technology and regularly updating software so it remains secure against new threats.

4) Legal Uncertainty: The cryptocurrency space is still very much in its infancy which means there are many unanswered questions about how certain laws will apply in different jurisdictions around the world. Exchanges must stay abreast of changes in legislation so they can adjust their operations accordingly or risk running afoul of regulators who are eager to crack down on non-compliant businesses.

5) Market Volatility: Cryptocurrencies are notoriously volatile which can create problems for those running an exchange if prices suddenly spike or plummet overnight due to market speculation. Exchange operators should implement risk management strategies like stop losses so they can mitigate any potential losses should markets move against them unexpectedly.

By understanding these key challenges ahead of time, those looking to launch their own crypto exchange can take steps towards ensuring compliance with applicable laws and regulations while also mitigating any potential risks posed by market volatility or security threats

Keeping Your Funds Safe from Hackers and Scams

In today’s digital world, it’s more important than ever to ensure your funds are safe when you make online transactions. Hackers and scammers are always looking for new ways to take advantage of unsuspecting people, so learning how to protect yourself is essential to keeping your money secure. Here are some tips for keeping your funds safe from hackers and scams:

1. Use Strong Passwords: It may seem obvious, but using strong passwords with a combination of letters, numbers, and symbols is the best way to keep your accounts secure. Avoid using the same password across multiple sites, or using easily guessed phrases such as “password” or “123456”.

2. Monitor Your Accounts Regularly: Checking in on your bank and credit card accounts regularly can help you spot any suspicious activity that could be a sign of fraud or a hacker getting access to your account information. You should also contact the company if you notice anything out of the ordinary on your statement or account page.

3. Be Cautious With Emails: Be wary of any emails that appear suspicious or ask for personal information such as passwords or banking details. Legitimate companies will never send an email asking for this type of information, so delete these messages immediately without clicking any links they contain.

4. Shop Securely Online: When shopping online, always look for websites that have SSL encryption enabled – this is indicated by a padlock icon in the address bar or at the bottom right corner of the browser window when you visit the site’s checkout page (the URL should start with “https://”). This ensures that all data transmitted between the website and user is encrypted and secure from hackers attempting to intercept it during transmission.

5. Don’t Give Out Financial Information Over The Phone: If someone calls claiming they need financial information from you – such as credit card numbers – do not provide them with this information over the phone unless you initiated the call and know who they are with certainty.. Scammers often use techniques like spoofing caller ID numbers in order to get victims to give up their sensitive information over the phone; never trust a caller until you can verify who they are independently first!

By taking these steps, you can help keep your funds safe from hackers and scammers while still enjoying all the benefits of making transactions online!

Conclusion: What Does the Future Hold for Crypto?

The potential for cryptocurrency is vast and, as the technology matures, so too does its reach and utility. Cryptocurrency has grown from a novelty to a legitimate means of exchange and investment, with many traditional institutions beginning to accept it as payment. With increased use of blockchain technology comes greater security, transparency, and trust in the system. Cryptocurrency may even become an alternative form of money in some parts of the world where traditional banking systems are unreliable or unavailable.

At the same time, cryptocurrency remains largely unregulated and is vulnerable to market volatility. Many governments remain wary of cryptocurrencies due to their lack of oversight and potential for fraud or money laundering. This could lead to further regulation in the future that could stifle innovation or limit investment opportunities.

Ultimately, the future will depend on how well cryptocurrency can adapt as it grows more widespread. If its proponents can create a secure system that is both trusted and regulated, then it may be poised to become a major force in both finance and global commerce. For now though, we can only wait with anticipation as we watch this exciting new technology continue its fascinating journey through our ever-changing world.